I started stock investment seriously in 2001. I resisted buying anything in 1999 and 2000 because I just couldn’t find any stocks to buy using my investment strategy.

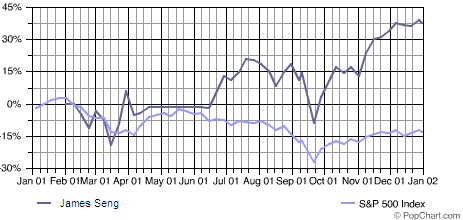

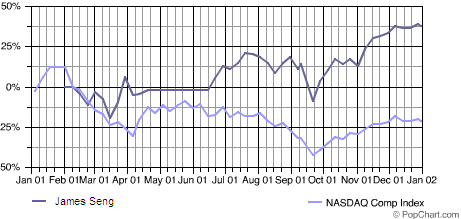

The .com bubble burst in 2001 opens some opportunities to invest. I remember I couldn’t sleep for a few days the first time I bought some shares. It was quite a substainable portion of my net worth then and the market is swingly crazyly. Nevertheless, it works out okay and I achieve a net gain of 37.97% compared to S&P (-13.04%) and NASDAQ (-21.05%).

|

YTD

|

JAN

|

FEB

|

MAR

|

APR

|

MAY

|

JUN

|

JUL

|

AUG

|

SEP

|

OCT

|

NOV

|

DEC

|

James Seng

|

37.97%

|

0.00%

|

-3.24%

|

9.67%

|

-7.24%

|

0.00%

|

14.96%

|

4.60%

|

0.20%

|

-12.76%

|

8.92%

|

18.71%

|

3.13%

|

Q1 Performance

6.12%

|

Q2 Performance

6.64%

|

Q3 Performance

-8.56%

|

Q4 Performance

33.35%

|

S&P 500

|

-13.04%

|

3.46%

|

-9.23%

|

-6.42%

|

7.68%

|

0.51%

|

-2.50%

|

-1.07%

|

-6.41%

|

-8.17%

|

1.81%

|

7.52%

|

0.76%

|

Q1 Performance

-12.12%

|

Q2 Performance

5.52%

|

Q3 Performance

-14.98%

|

Q4 Performance

10.30%

|

NASDAQ

|

-21.05%

|

12.23%

|

-22.39%

|

-14.48%

|

15.00%

|

-0.27%

|

2.37%

|

-6.17%

|

-10.94%

|

-16.98%

|

12.77%

|

14.22%

|

1.03%

|

Q1 Performance

-25.51%

|

Q2 Performance

17.41%

|

Q3 Performance

-30.62%

|

Q4 Performance

30.13%

|

|

|

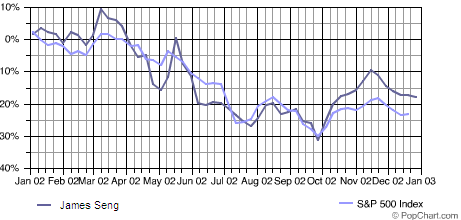

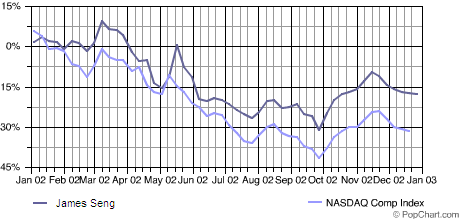

2002 is a bad year. After 9/11, the market recovery slightly only to encounter Worldcom and Enron. The market sentiment horrible. It was the time when those who makes money are the ones who do short-selling. I was tracking RSAS then and was buying them as the prices falls. Needless to say, I lost a chuck of my portfolio on RSAS. I turn out to be right later and I close the year with a net lose of -17.93% compared to S&P (-23.37%) and NASDAQ (-31.53%).

|

YTD

|

JAN

|

FEB

|

MAR

|

APR

|

MAY

|

JUN

|

JUL

|

AUG

|

SEP

|

OCT

|

NOV

|

DEC

|

James Seng

|

-17.93%

|

-1.24%

|

-1.91%

|

7.52%

|

-16.66%

|

2.09%

|

-9.17%

|

-4.78%

|

0.23%

|

-6.45%

|

14.01%

|

8.54%

|

-7.72%

|

Q1 Performance

4.16%

|

Q2 Performance

-22.72%

|

Q3 Performance

-10.72%

|

Q4 Performance

14.19%

|

S&P 500

|

-23.37%

|

-1.56%

|

-2.08%

|

3.67%

|

-6.14%

|

-0.91%

|

-7.25%

|

-7.90%

|

0.49%

|

-11.00%

|

8.64%

|

5.71%

|

-6.03%

|

Q1 Performance

-0.07%

|

Q2 Performance

-13.74%

|

Q3 Performance

-17.63%

|

Q4 Performance

7.92%

|

NASDAQ

|

-31.53%

|

-0.84%

|

-10.47%

|

6.58%

|

-8.51%

|

-4.29%

|

-9.44%

|

-9.22%

|

-1.01%

|

-10.86%

|

13.45%

|

11.21%

|

-9.69%

|

Q1 Performance

-5.38%

|

Q2 Performance

-20.70%

|

Q3 Performance

-19.90%

|

Q4 Performance

13.94%

|

|

|

Charts and data from my E*Trade account.